While it may not be the most enjoyable part of farming, good record keeping on the farm is necessary, important, and extremely helpful. I was asked to train on this topic several years ago for a beginning farmer class, so thought it may be beneficial to share here as well.

While the possibilities are probably endless for different record keeping options, I will be sharing what has worked well for us on our farm. First I will start with the financial side of record keeping, and then cover the production side in a later post.

What are Financial Records

The financial side, or the money side, of record keeping mainly consists of all income and expenses. Income is any money that is received by your farm. The largest income category for our farm is the sale of crops. Expense is any money that is spent by your farm. This could include equipment purchases, labor, parts, and crop inputs such as seed, fertilizer, crop insurance, fuel, irrigation expense, etc.

Why Financial Records are Important

Good financial record keeping is not only beneficial for yourself, but also for your bank and your accountant when it comes time to file your taxes. For you, it is important to analyze past farm productivity and to project future farm earnings.

These records are a great way to make sure you are meeting your overall business goals and making a profit each year. Knowing what performs well on your farm helps to make profitable decisions for the upcoming years.

Accurate record keeping will also be helpful to you when it comes time to put together your financial statements for the bank. Our bank requires an income statement, balance sheet, and projected cash flow each year. These documents are so much easier to put together if you have all your financials recorded and accessible in one location. The extra time I take throughout the year to record our financial information properly saves me time at the end of the year when I need all the information for these documents.

Types of Record Keeping Systems

There are a couple different options available when it comes to the types of record keeping systems. Here I will discuss the pros and cons of each:

1.Hand System- simply a notebook or specific record keeping manual that can be obtained usually from private or government lending agencies (banks, possibly FSA)

PROS-

- Cheaper

- Easy to learn

- Easy to access

CONS-

- Possible mathematical errors

- Limited Analysis

- You have to prepare the reports by hand

2. Computerized System- simply a spreadsheet or special software designed specifically for financial record keeping (QuickBooks, Quicken, Farm Biz, etc)

PROS-

- Accuracy

- Faster

- Better analysis tools

CONS-

- More expensive

- Takes longer to learn and setup

- Limited access (need to have a tablet or computer to access)

I personally use QuickBooks Desktop and have since the start of keeping records for our farm (+15 years). Therefore, I can not comment on how well the other programs (Quicken & Farm Biz) listed above work. I do keep and use some hand systems, but the majority of our financial record keeping is done through QuickBooks and spreadsheets.

Benefits of QuickBooks

Separate Fields/Job Report

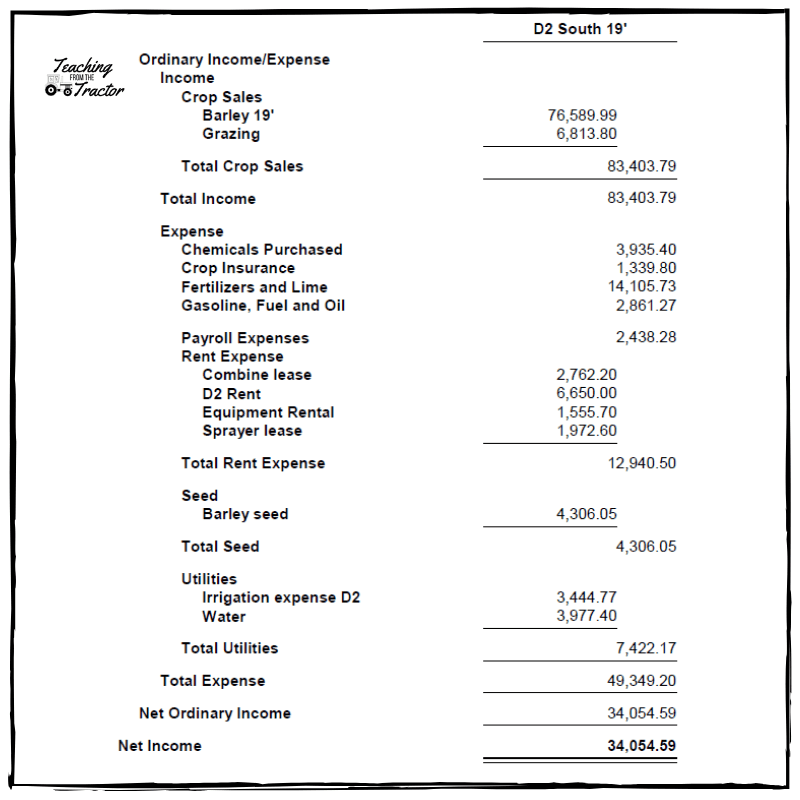

My favorite part of QuickBooks and what I find the most useful is the ability to create each one of our fields as a job and track the expenses and income that way. For instance, I can assign the seed, fuel, fertilizer, rent, crop sales, etc to each field where the money was spent/received. This makes it super easy at the end of the year to see how profitable each field/crop was. This also makes it easy for when I am preparing the projected cash flow for the following crop year.

Here is an example of a Profit & Loss by Job report for one of our 2019 barley fields.

Knowing how many acres was included in this field, I can then divide each total amount by the acres and know how much money was spent/received per acre in these main categories. Certain areas do need to be adjusted each year. For instance, the price of fuel and fertilizer changes year to year and may need to be adjusted accordingly.

Knowing how many acres was included in this field, I can then divide each total amount by the acres and know how much money was spent/received per acre in these main categories. Certain areas do need to be adjusted each year. For instance, the price of fuel and fertilizer changes year to year and may need to be adjusted accordingly.

The biggest challenge I face when it comes to this is making sure the inputs are assigned to the right field. It helps that I am on the farm and do some of the work, but there are times where I may get a large fertilizer bill with no description and not know exactly what field it was used on. Thankfully I just ask my husband and he is able to let me know (most of the time).

Inputting Data

I generally try to input our financial information into QuickBooks twice a month. I do this at the same time I pay bills. This keeps the information fresh on my brain and makes it easier to assign inputs to the right field. If I waited until the end of the year, it would definitely make it more difficult remembering where things went and which field they needed to be assigned to.

Once I have input the information into QuickBooks, I then file that paperwork into my filing cabinet. At the end of the year, I put all the paperwork from that year into a box and file it into my attic. For the most part, all of my information is now in QuickBooks and very rarely do I have to go find something I have filed away. I like to keep it just in case. I know there are options for uploading receipts and things so you do not have to keep all that paper, but I like to be old school when it comes to filing our paperwork. 🙂

Analysis Tools

Another reason I love QuickBooks is that it is an excellent analysis tool. It has over 100 different reports that you can customize, and also has different charts and graphs that can be created easily. I probably don’t even use ½ of the features QuickBooks has to offer, but I am very happy with what I do use.

Preparation of Important Documents-

Finally, as briefly noted above, QuickBooks makes it easy when it is time to prepare these important documents:

Finally, as briefly noted above, QuickBooks makes it easy when it is time to prepare these important documents:

- Balance Sheet

- Income Statement

- Actual & Projected Cash Flow

- Income Taxes

- 1099’2 & W-2’s

The balance sheet, income statement, and cash flow are all reports that QuickBooks will generate for you. I like to prepare my own balance sheet the way the bank wants it, but I do refer to QuickBooks for the majority of my information. This includes looking at account balances, prepaid expenses, and accounts receivables just to name a few. I use an excel spreadsheet for preparing our balance sheet and cash flow.

We do have an accountant that prepares our taxes for us, but it doesn’t take me long to send him all the information he needs from QuickBooks. In 2019 our accountant retired, so I decided to prepare our own 1099 and W-2 forms for the year. I was surprised at how simple it was.

We use QuickBooks for our payroll, so it already had the information it needed. It walked me through the process step by step for both the 1099’s and W-2’s. I will definitely be doing these forms for our business every year now that I know how simple it is.

We use QuickBooks for our payroll, so it already had the information it needed. It walked me through the process step by step for both the 1099’s and W-2’s. I will definitely be doing these forms for our business every year now that I know how simple it is.

I absolutely love the payroll feature on QuickBooks!! It not only automatically calculates payroll taxes for me, but it also makes it simple to pay and file our payroll taxes online.

Record Keeping on Your Farm

I hope you found some helpful tips in this post. Please share any tips and tricks you have when it comes to financial record keeping on your farm. I haven’t explored too many other record keeping options since I have QuickBooks set up to my liking. However, I am sure there are some amazing other programs out there that will do just as good of a job. Leave a comment and let me know what you use and love! Happy record keeping!